What is Timeswap?

An overview of what Timeswap is, its key features, and a quick navigation guide

Timeswap is the first oracleless lending/borrowing protocol. Timeswap enables the creation of money markets for ANY ERC-20 tokens.

By design, all loans in Timeswap are non-liquidatable and fixed-term. Timeswap operate entirely without oracles, and thus bears no oracle manipulation risks, which is highly prevalent in DeFi. Timeswap's oracle independence allows the creation of lending/borrowing markets for any ERC-20 tokens.

Timeswap is currently live across Arbitrum, Mantle, Polygon PoS, Polygon zkEVM and Base.

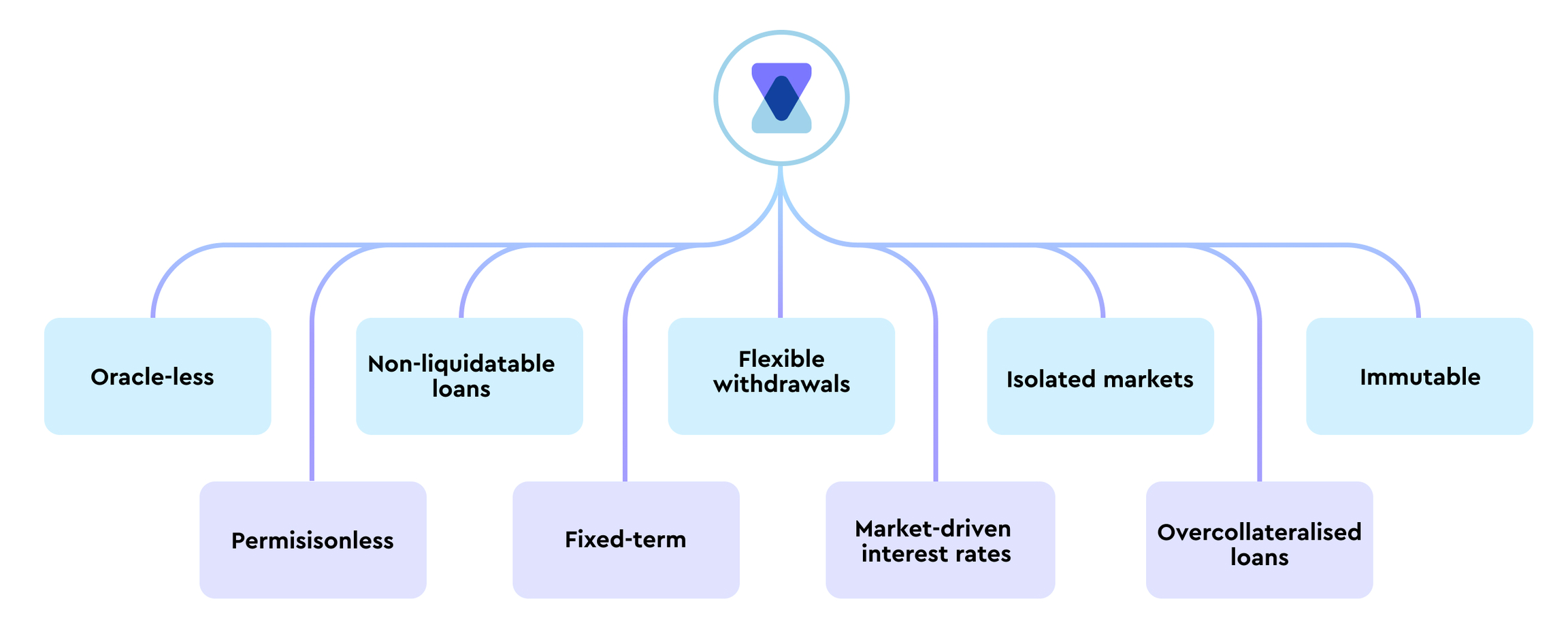

Key features of Timeswap:

Oracleless: Timeswap works without any oracles by shifting the pricing and risk management process to the users. Benefits of this design include being immune to oracle manipulation attacks and the ability to support lending/borrowing markets for any ERC-20 tokens.

Permissionless: Anyone can create markets for any ERC-20 tokens through Timeswap. Additionally, anyone can lend, borrow, and provide liquidity to any existing pools.

Non-liquidatable loans: Borrowers in Timeswap enjoy the security of non-liquidatable loans. This means they can borrow against their token holdings without the constant need for active loan management. In the event of failure to repay the loan before maturity, the collateral provided by the borrower will be forfeited.

Fixed-term: All lending and borrowing transactions in Timeswap have a pre-defined loan duration (with respect to the pool) and a fixed interest rate (once the lender/borrower opens a position), providing certainty to users.

Flexible withdrawals: Despite being fixed-term, users (lenders, borrowers and liquidity providers) can exit from their positions early. However, it's important to note that early withdrawals may incur slippage, which is further explained in the Deep Dive section of this documentation.

Market-driven interest rates: Interest rates in Timeswap is determined by the free market through a generalised AMM (inspired by Uniswap V2's x*y=k AMM), no historical data (e.g., utilisation ratio) is stored in the AMM, resulting in unbiased interest rates.

Isolated markets: All lending/borrowing pools in Timeswap are isolated from one another, this ensures that each risks are contained within a pool and participants of a pool is not affected by the outcome of another.

Overcollateralised loans: Timeswap's design of states and adoption of arbitrage ensures that at any given time and price, borrowers cannot obtain undercollateralised loans. This ensures security and stability to the lenders.

Immutable: Being a base-layer protocol, once a Timeswap contract/pool is deployed, it cannot be changed. Certain protocol-level parameters (e.g., fee switch, token distribution, etc.) will be changable through governance (once $TIME is live).

Timeswap revolutionises the DeFi lending/borrowing landscape by offering a fully decentralized protocol that operates without oracles or governance.

Here are some important pages to get you started in your Time Traveling journey!

Important links: An aggregation of all links Timeswap!

🔗pageImportant LinksMarket Participants: A generalised overview of the different market participants in Timeswap.

pageMarket ParticipantsPool Parameters and Scenarios: A quick glimpse into how a Timeswap pool works, in action!

pageHow it WorksDeep Dive: For you curious minds to learn about how exactly Time Traveling works.

pageThe AMMLast updated