TIME premine

Premine of TIME Tokens

The TIME token premine serves as an incentive mechanism for Timeswap protocol participants, including Lenders, Borrowers, and Liquidity Providers. During the premine phase, users will receive non-transferable TIME tokens, which can be later claimed for TIME tokens during the Token Generation Event (TGE).

TIME tokens earned during the premine phase can be claimed at a 1:1 ratio with no vesting schedule during the TGE. The TGE will tentatively happen in Q1 2024.

Rewards APR

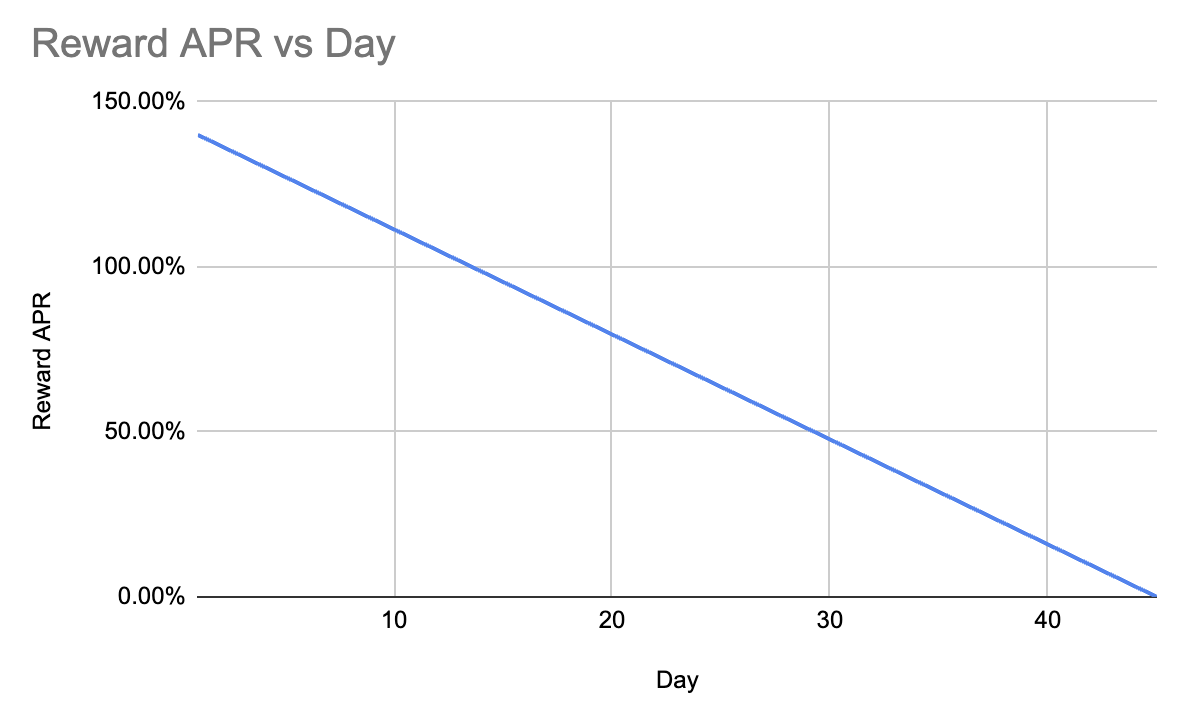

The rewards Annual Percentage Rate (APR) is calculated based on a $40 million Fully Diluted Valuation (FDV), following the valuation of our previous funding round. The Rewards APR will decrease linearly due to the time decay in rewards.

Here's how the Rewards APR changes over time:

Pools to Be Rewarded

The initial premine will incentivize our "Flagship Pools," beginning with ARB/USDC, where we have observed consistent demand from lenders and borrowers.

The list of incentivised pools can be found in this spreadsheet.

Following the Token Generation Event (TGE), the TimeswapDAO will be established, responsible for orchestrating incentives across various pools.

Last updated