LP FAQ

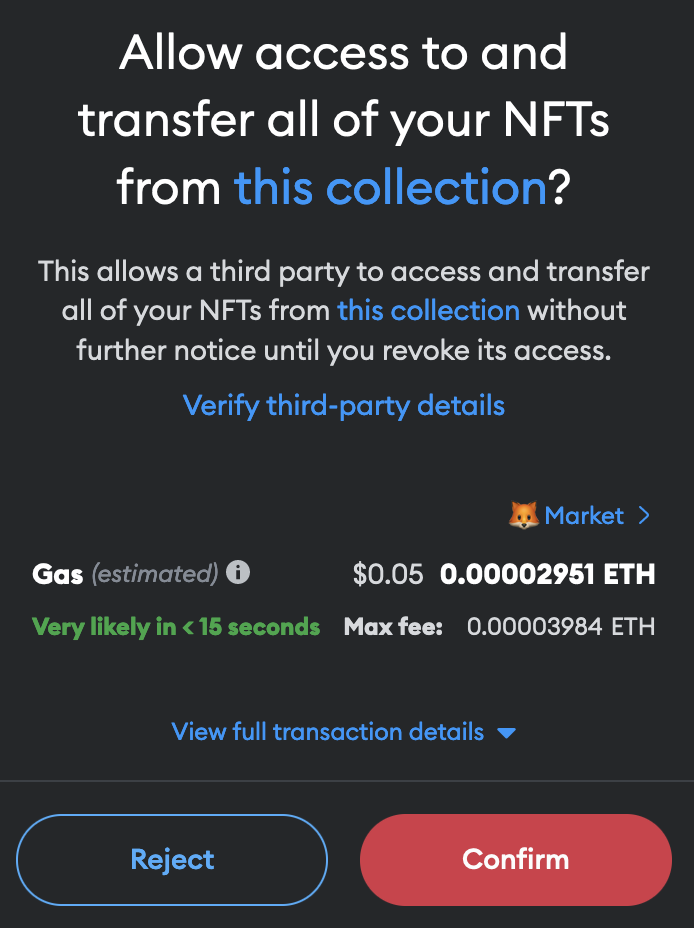

Why do I need 2 approvals?

Your Liquidity Position on Timeswap consists of "Liquidity Earning Fees" and "Liquidity Earning Yield", each of these are represented using ERC-1155 NFTs. When removing liquidity, you need to approve both of these tokens.

Approving the request as shown in the above screenshot only allows the Timeswap smart contract to access the Timeswap (position) collection; it does not grant access to any of your other NFT collections.

In order to close your loan position, the Timeswap smart contract has to access the active NFTs.

Additionally, you could revoke access to the request using revoke.cash upon closing the loan positions.

How is LP different from lending?

Liquidity Providers and Lenders fundamentally differ in terms of their source of yield and the risk exposure

Lenders have a single source of yield which is the deposit APR, which is a fixed return.

Liquidity Providers on the other hand have two sources of yield:

Fees APR -> LPs earn transaction fees on all the lend/borrow transactions.

Interest Spread -> LPs also earn interest on their capital when the borrow demand exceeds the lending demand.

This means that the payoff of LPs are variable.

What is liquidity earning yield?

It is the amount of your total liquidity being used as a lending liquidity. This liquidity will be available to be borrowed from the pool.

What is liquidity earning fees?

The amount of liquidity actively being used for facilitating lending/borrowing in the pool in return for transaction fees.

Where does the fees come from?

It comes from the interest earned by lenders and the interest paid by borrowers.

Every time a lend/borrow transaction takes place, a 10% fees is charged on the "Interest amount" of the user. The 5/6 portion of the fees (or 8.33% of the interest amount) goes to liquidity providers. Whereas 1/6 of the fees (or 1.66% of the Interest amount) is the protocol fees going to the Timeswap DAO.

What are the risks associated with LPing?

There are two risks associated with LPing:

Transition Price: Similar to lenders, the LPs are also exposed to the Transition price. Transition price (a.k.a. strike price) is the price point at and beyond which borrowers are expected to default, and the pool (asset) flips.

Interest Spreads: When you LP in a pool with little to no borrow demand, the amount of interest earned by lenders > amount of interest paid by borrowers. This can lead to a loss, which is limited to "Liquidity earning fees"

Why is my liquidity position value different from the amount while removing liquidity?

Timeswap is fixed maturity market but pre maturity exit is enabled at the potential cost of slippage depending on the available liquidity in a pool. To reduce slippage you can either wait for more liquidity to be added to the pool or wait for the pool to mature (for zero slippage).

Last updated