Lenders

Lenders are users who fund Timeswap pools -- to allow borrowers to borrow from -- in return for earning a fixed interest

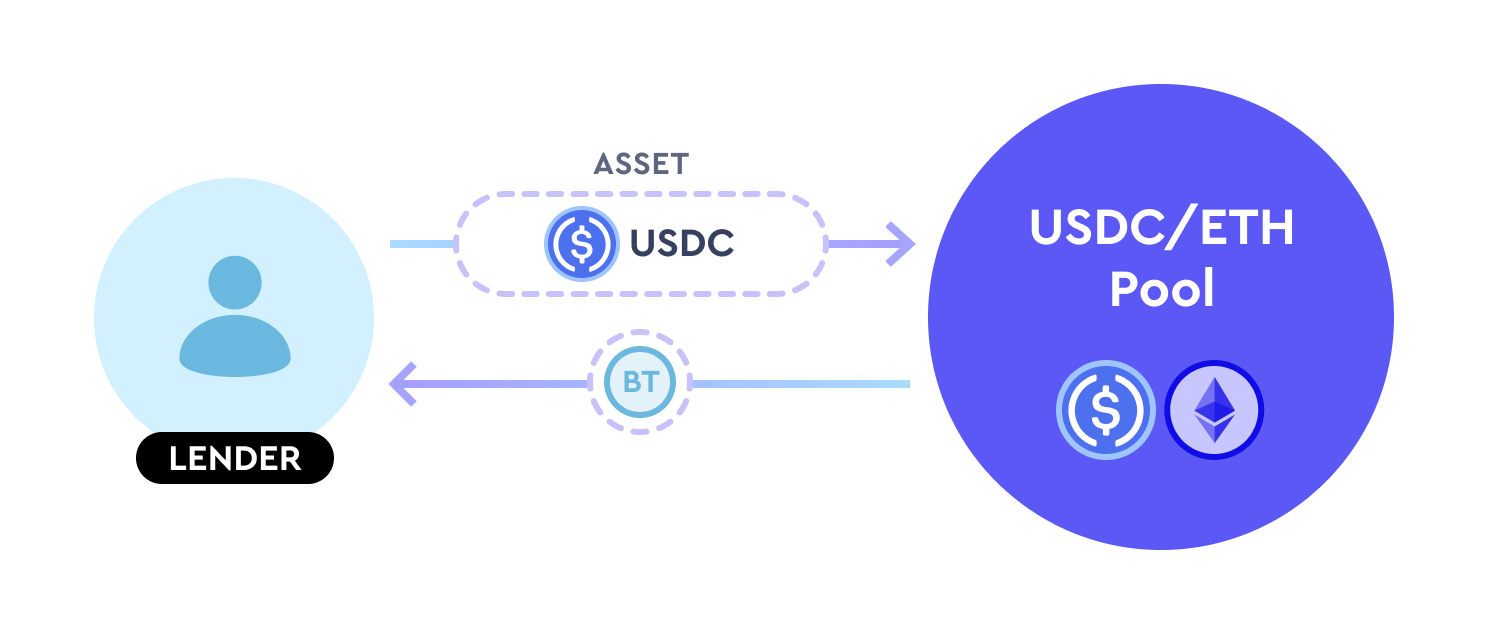

Below is a diagram that highlights the interaction of a lender with Timeswap's pools, for a USDC/ETH pool (where lenders can lend USDC, borrowers can borrow USDC by locking ETH collateral).

Since Timeswap loans are fixed-term and non-liquidatable, at maturity, lenders either receive the supplied (e.g., USDC) or collateral asset (e.g., ETH). The outcome depends on the aggregate decision of the borrowers. In either case, lenders will always receive the locked-in interest (as the borrowers pay the interest upfront). If borrowers repay their debt, lenders will receive the supplied asset. If borrowers default on their debt, the lenders will receive the collateral asset.

The price level at which the actions of the borrower is expected to change is called the transition price (TP).

As a result, the risk profile of a lender in Timeswap is different than that of a conventional DeFi lending/borrowing protocol (e.g., AAVE, Compound, etc). In the conventional DeFi lending/borrowing protocol, liquidations help manage the health of the protocol (and thus lenders), and lenders can be seen as a 'lend and forget' participant. Whereas in Timeswap, lenders have to manage their own risk/reward ratios when lending into a pool.

Despite being fixed-term in nature, lenders can exit from their positions early. However, it's important to note that early withdrawals may incur slippage, which will be further explained in the Deep Dive section of this documentation. This provides lenders with the option to manage their risk exposure mid-maturity.

Lenders provide the supplied asset (e.g., USDC) and receives an ERC-1155 receipt token, called the Bond Token (BT).

Last updated