Liquidity Providers (LPs)

Liquidity providers (LPs) are users who provide liquidity to Timeswap pools -- to act as the counterparty to lenders and borrowers -- in return for transaction fees

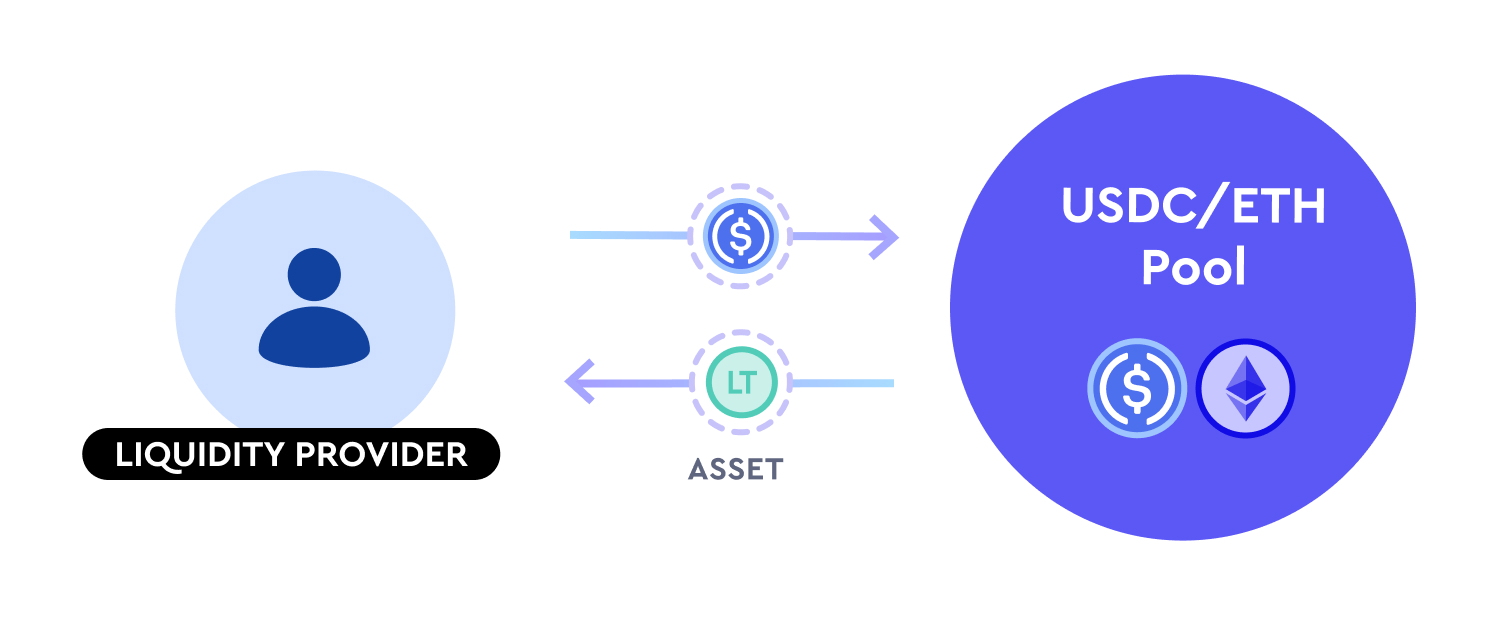

Below is a diagram that highlights the interaction of a liquidity provider with Timeswap's pools, for a USDC/ETH pool (where lenders can lend USDC, borrowers can borrow USDC by locking ETH collateral).

The role of an LP in Timeswap is comparable to that of Uniswap. In Uniswap, LPs act as the counterparty to buyers and sellers (e.g., LPs (through the pool) sell to buyers and buy from sellers, in exchange for a transaction fee). In Timeswap, LPs borrow from lenders and lend to borrowers, in exchange for a transaction fee.

In the conventional DeFi lending/borrowing protocol (e.g., AAVE, Compound, etc.), there are only two main market participants: 1) lenders, and 2) borrowers. However, this design means that the interest rate for lenders and borrowers will be variable, based on the pool's utilisation. With Timeswap, lenders and borrowers will receive a fixed return (or pay a fixed interest) upon opening a position (and has the ability to exit anytime before maturity), hence another participant (the LP) is needed to match the total interest paid out to lenders and received from borrowers.

Similar to lenders, the assets LPs receive at maturity depends on the aggregate decision of the borrowers. If borrowers repay their debt, LPs will receive the supplied asset. If borrowers default on their debt, LPs will receive the collateral asset. Additionally, LPs are exposed to the risk of divergence loss (i.e., impermanent loss (IL)) depending on the net interest spread (interests paid to lenders vs interests earnt from borrowers).

In exchange for the adverse position, LPs earn a fee for every lending/borrowing transaction.

Despite being fixed-term in nature, LPs can withdraw their positions early. However, it's important to note that early withdrawals may incur slippage, which will be further explained in the Deep Dive section of this documentation. This provides LPs with the option to manage their risk exposure anytime before maturity.

LPs provide the supplied asset (e.g., USDC) and receives an ERC-1155 receipt token, called the Liquidity Token (LT).

Similar to Uniswap, the first LP of a pool (i.e., pool creator) gets to set the initial parameters of the Timeswap pool (more details in the Pool Creation section).

Last updated