Borrowers

Borrowers are users who borrow from Timeswap pools -- where liquidity is seeded by lenders and liquidity providers -- without needing to manage their positions (as there are no liquidations) in return

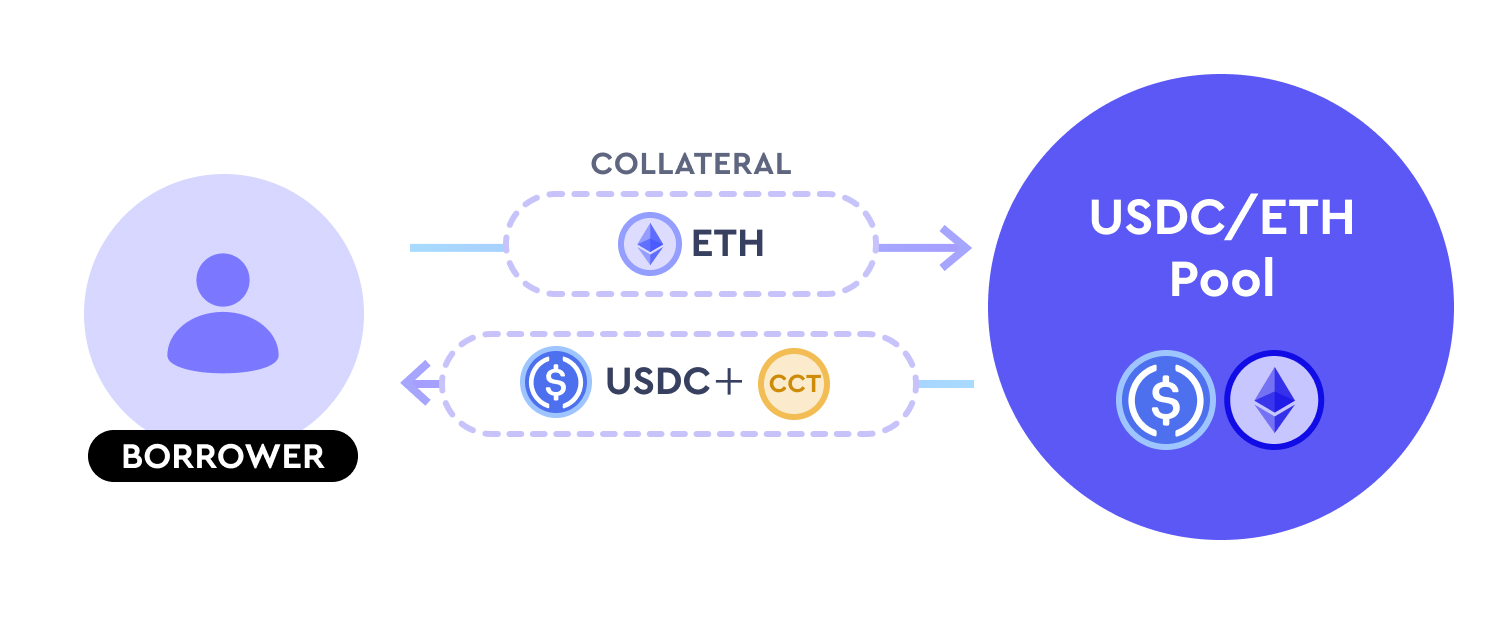

Below is a diagram that highlights the interaction of a borrower with Timeswap's pools, for a USDC/ETH pool (where lenders can lend USDC, borrowers can borrow USDC by locking ETH collateral).

Since Timeswap loans are fixed-term and non-liquidatable, at maturity, borrowers have the option to either repay their debts or forfeit their collateral (by comparing the value of their debt vs locked collateral). In either case, the interest will be paid to lenders and liquidity providers (in the form of locked collateral if they default; in the form of the borrowed asset if they repay). The price level at which the optimal action (to repay or to default) of a borrower is expected to change is called the transition price (TP). There is an emphasis on 'expected' since the price level does not take into account each borrower's debt (and if they are rational actors based on the economic outcomes).

As a result, the risk profile of a borrower in Timeswap is different than that of a conventional DeFi lending/borrowing protocol (e.g., AAVE, Compound, etc). In the conventional DeFi lending/borrowing protocol, liquidation (and liquidation fees) forces borrowers to actively monitor the health of their positions (collateral vs debt in real-time). Whereas in Timeswap, borrowers do not have to manage their positions -- they can simply decide whether to repay or not based on the values of their locked collateral vs debt, at maturity -- and can be seen as a 'borrow and forget' participant. In conclusion, borrowers are able to unlock capital while receiving a downside protection on their asset.

Despite being fixed-term in nature, borrowers can close their debt early. However, it's important to note that early withdrawals may incur slippage, which will be further explained in the Deep Dive section of this documentation. This provides borrowers with the ability to unlock capital for a time period at their discretion.

Borrowers locks in a collateral asset (e.g., ETH) to receive the borrowable asset (e.g., USDC) and an ERC-1155 receipt token, called the Collateral Claim Token (CCT).

Last updated