How it Works

A practical guide to Timeswap pools

Here's the quickest overview on Timeswap's pool parameters and its relationships (~5 mins):

Note that the above blog is highly abstracted and ignores the role of liquidity providers, to learn more about liquidity providers, read here.

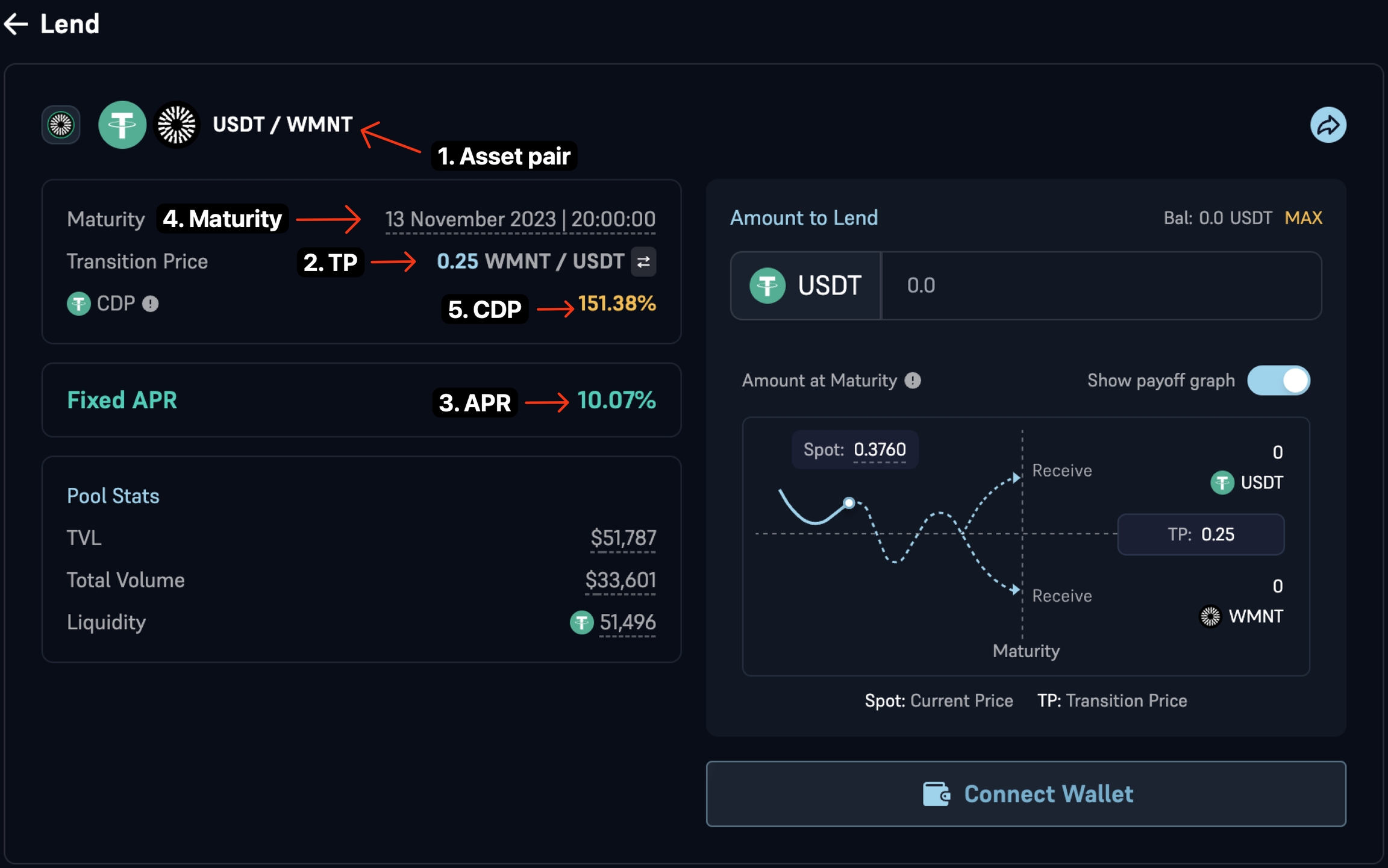

A Timeswap pool is defined by the following parameters:

Asset pair: The asset pair of the pool (e.g., ETH/USDC).

Transition price (TP): The price level at which borrowers are expected to change their actions (whether to repay their loans).

APR: The annualised interest rate at which borrowing and lending occurs (subject to change after every lending/borrowing transaction).

Maturity: The date and time at which the pool expires.

CDP: A figure to assists borrowers and lenders gauge their loan's collateral factor and unit coverage respectively.

A Timeswap pool is uniquely defined by its 1) asset pair, 2) transition price and 3) maturity. There can be multiple pools for the same asset pair (e.g., two ARB/USDC pools, one with 1 week maturity and another with 2 months maturity).

An Example

Here is an example to showcase a borrowing transaction for a pool with the following parameters to highlight how the parameters come into play:

Asset pair: ETH/USDC

Spot price of ETH: 1,000 ETH/USDC

Transition price: 800 ETH/USDC

APR: 24%

Maturity: 1 month (after pool launch)

Since the spot price of ETH is higher than the transition price of the pool, the pool allows borrowers to borrow USDC against ETH collateral and lenders to lend USDC. If the spot price of ETH is lower than the transition price of the pool, the pool allows borrowers to borrow ETH against USDC collateral and lenders to lend ETH.

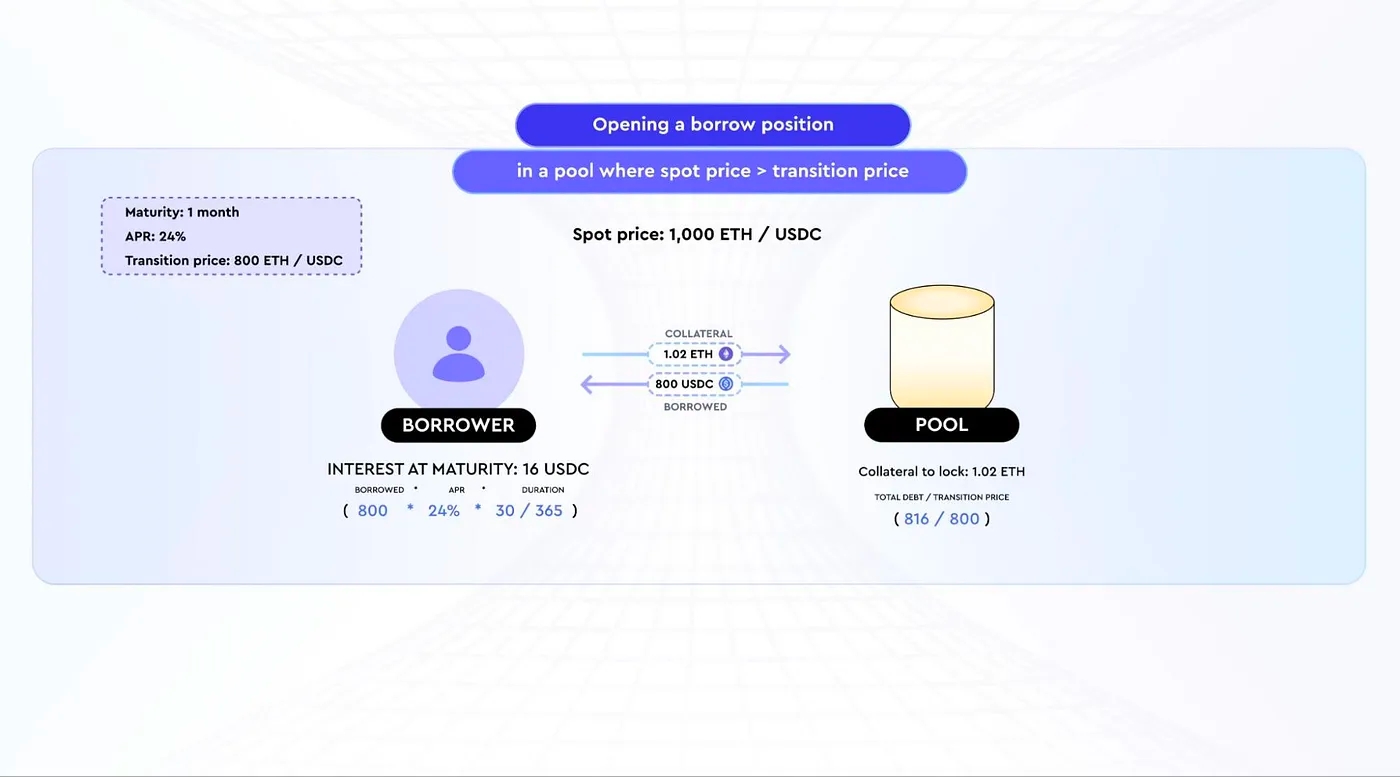

Opening the borrow position

The borrower wants to borrow 800 USDC.

The interest at maturity for the loan is 16 USDC (borrowed principal * APR * duration = 800 * 24% * 30/365).

Total debt of the borrower is 816 USDC (borrowed principal + interest at maturity = 800 + 16).

The collateral to be locked by the borrower is 1.02 ETH (total debt / transition price; 816/800).

Closing the borrow position at maturity

There are two possible scenarios at maturity with respect to the price action of the pair: 1) spot price of ETH > transition price and 2) spot price of ETH < transition price.

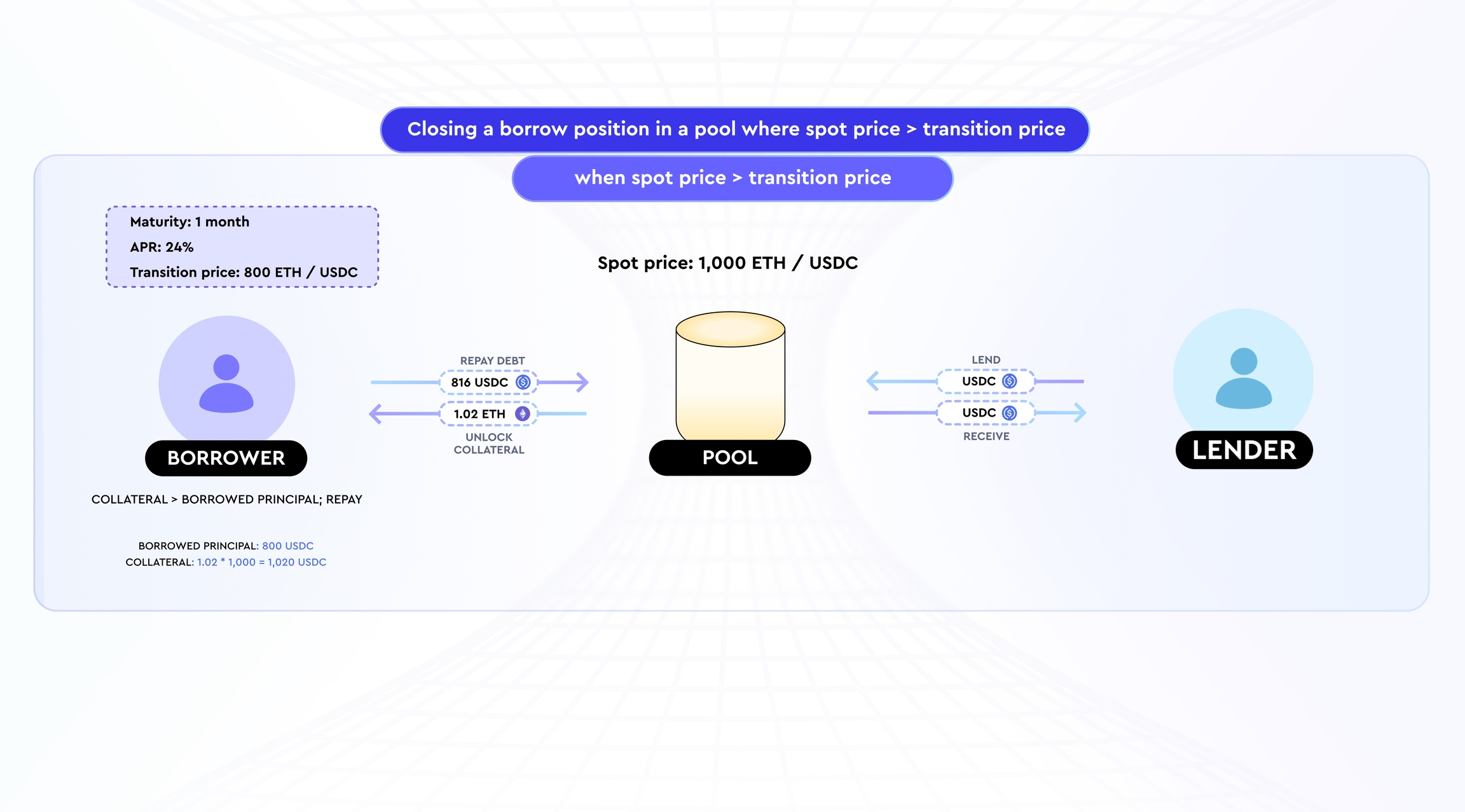

1) Closing the borrow position (at maturity) when spot price of ETH > transition price

Let's consider the case where the price of ETH remains at 1,000 ETH/USDC.

At maturity, the borrower's borrowed principal (i.e., cash on-hand) is 800 USDC.

The borrower's locked collateral is worth 1,020 USDC (locked collateral * spot price = 1.02 * 1,000).

Since the borrower's locked collateral is worth more than their borrowed principal, it makes more economic sense for them to repay the debt (and thus unlock the collateral).

As a result, lenders (and LPs) will receive their principal and interest in the form of USDC.

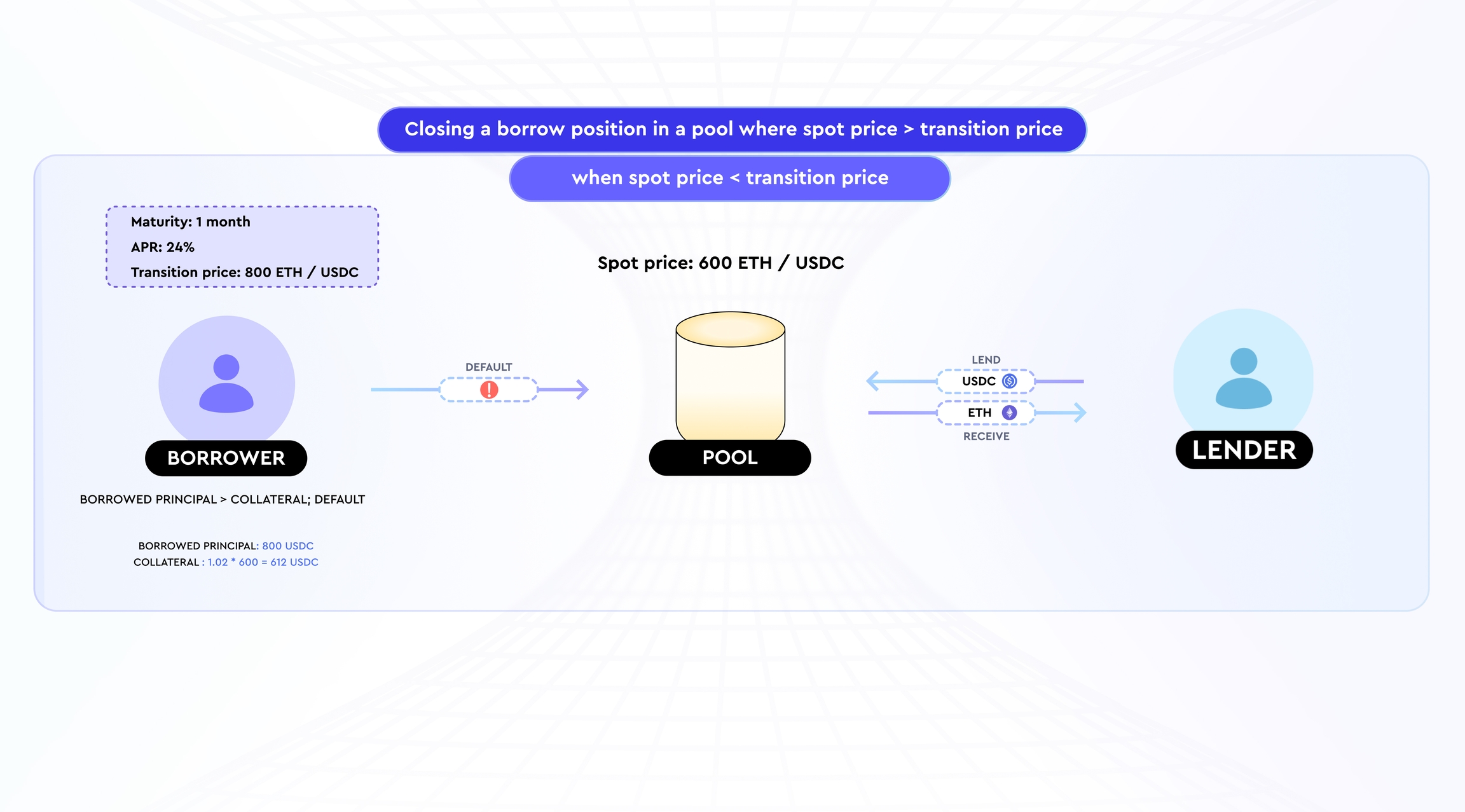

2) Closing the borrow position (at maturity) when spot price of ETH < transition price

Let's consider the case where the price of ETH drops to 600 ETH/USDC.

At maturity, the borrower's borrowed principal (i.e., cash on-hand) is 800 USDC.

The borrower's locked collateral is worth 612 USDC (locked collateral * spot price = 1.02 * 600).

Since the borrower's borrowed principal is worth more than the locked collateral, it makes more economic sense for them not to repay on the debt (and thus forfeit the locked collateral).

As a result, lenders (and LPs) will receive their lent principal and interest in the form of ETH (from the borrower's collateral).

The below diagram summarises the expected outcomes of Timeswap pools based on the relationship between transition price and the spot price at maturity:

Last updated