Market Participants

There are three main market participants in Timeswap: 1) lenders, 2) borrowers, and 3) liquidity providers (LPs)

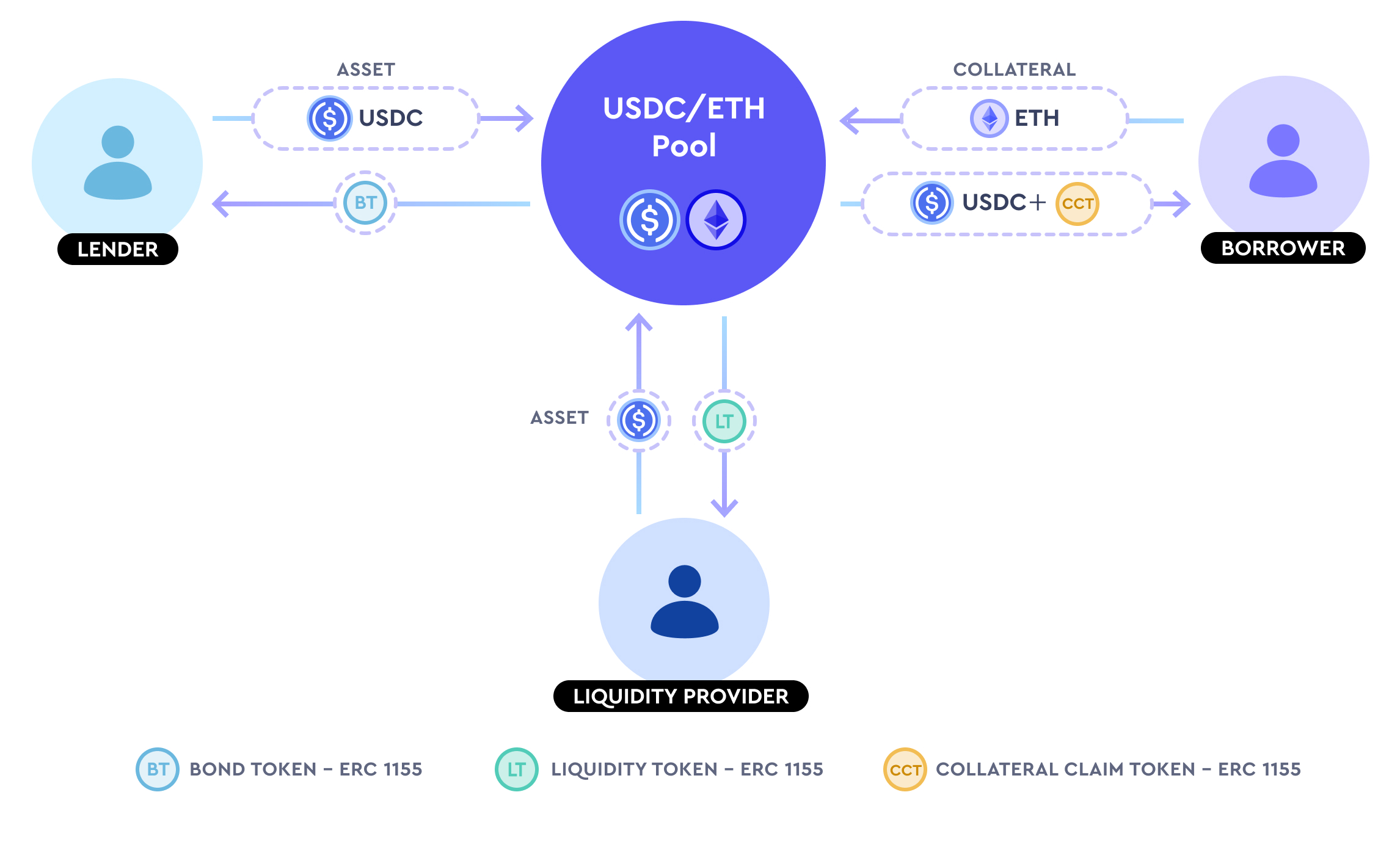

Below is a diagram that encapsulates the relationship of the market participants and Timeswap's pools, for a USDC/ETH pool (where lenders can lend USDC, borrowers can borrow USDC by locking ETH collateral).

Lenders

Lenders are users who fund Timeswap pools -- to allow borrowers to borrow from -- in return for earning a fixed interest. 10% of lenders' earnt interest is paid to LPs as transaction fees.

More information on lenders below:

pageLendersBorrowers

Borrowers are users who borrow from Timeswap pools -- where liquidity is seeded by lenders and liquidity providers -- without needing to manage their positions (as there are no liquidations) in return for paying a fixed interest (upfront, in the form of collateral locked). Basically, a borrower needs to lock collateral equivalent to the amount of interest accrued to the borrowed principal. The collateral will be returned to the borrower once the Principal + Interest amount is paid back. 10% of borrowers' paid interest is paid to LPs as transaction fees.

More information on borrowers below:

pageBorrowersLiquidity Providers (LPs)

Liquidity providers (LPs) are users who provide (single-sided) liquidity to Timeswap pools -- to act as the counterparty to lenders and borrowers -- in return for transaction fees paid by lenders and borrowers (10% of the interests).

More information on LPs below:

pageLiquidity Providers (LPs)Last updated